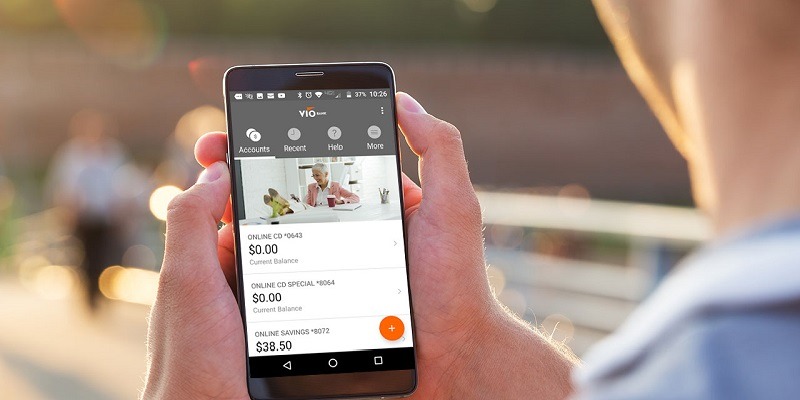

If you prefer to manage your banking online with guaranteed security, then Vio Bank might be most convenient option for you. To find out more about Vio Bank, continue reading this review below.

Launching as a subdivision of MidFirst Bank, Vio Bank was created for those who preferred banking online especially when it comes to finding the best interest rates without needing to leave the comfort of their home.

They may not have any checking accounts being an online bank, but the minimum deposit requirements are low, and their customer service is known to be praise worthy. They also pride themselves to be FDIC insured on all their accounts.

Savings Account Options

Vio Bank has one savings account, but it is nationwide and it offers a 2.52% APY for 120 months!

You will need a minimum opening deposit of $100, but afterwards, there are no minimum balance requirements to maintain.

However, there are also no monthly fees to worry about either.

The best part is interest is compounded daily so your money can continuously grow with each new deposit.

If you want to learn more about this particular online savings account, click here.

Compare Savings Accounts

Open a Discover® Online Savings Account for all these features: • Earn $200/$150 Bonus with promo code LOP325 by 9/11/2025 • Earn high interest rate of 3.70% APY • No minimum opening deposit, no minimum balance requirement, and now no fees • Interest on Discover Online Savings Accounts is compounded daily and credited monthly • Manage your account online or with the Discover mobile app • FDIC insurance up to $250,000 • See advertiser website for full details To qualify for Bonus: Apply for your first Discover Online Savings Account, enter Offer Code LOP325 at application, deposit into your Account a total of at least $15,000 to earn a $150 Bonus or deposit a total of at least $25,000 to earn a $200 Bonus. Qualifying deposit(s) may consist of multiple deposits and must post to Account within 45 days of account open date. Maximum bonus eligibility is $200. What to know: Offer not valid for existing or prior Discover savings customers. Eligibility is based on primary account owner. Account must be open when bonus is credited. Bonus will be credited to the account within 60 days of qualifying for the bonus. Bonus is subject to tax reporting. Offer ends 09/11/2025, 11:59 PM ET. Offer may be modified or withdrawn without notice. Due to new customer funding limits, you may wish to initiate fund transfers at your other institution. For information on funding, see FAQs on Discover.com/Bank. |

CD Account Options

If you are interested in opening a high yield CD online, then Vio Bank has CD terms ranging from 6 months to 10 year.

All their CDs offer competitive interest rates and will renew automatically upon maturity. Learn more about Vio Bank’s CDs here.

You will need $500 to open each CD, but afterwards there are no monthly fees.

There is, however, a penalty for early CD withdrawals, and they vary depending on the term’s length.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.00% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

Reasons to Bank with Vio Bank

- All the accounts have a low minimum deposit of $100 to open to compensate for not having to pay monthly fees or keep minimum balance requirements.

- All the accounts earn high interest rates, some earning tiered and each account is compounded daily so you can maximize your earnings.

- Do all your banking online in the comfort of your own home or on-the-go anytime, anywhere.

Reasons Not to Bank with Vio Bank

- There are no checking accounts so spending has to be monitored by your own means.

- Since Vio Bank is an online bank, there are no physical locations so you have to do all your banking online or over the phone.

- There are no ATMS to withdraw your funds from either.

- Vio Bank charges $5 per month for inactivity, so be sure to always check your account.

- There is a $10 fee per month after 6 transactions have been made.

Vio Bank Routing Number

The routing number for Vio Bank is 303087995.

Contact Customer Service

Vio Bank’s customer service is 888-999-9170, and automated service is available 24/7.

To speak to a representative at Vio, please consider these times (CST):

- Monday – Friday, 7:00 a.m. – 9:00 p.m.

- Saturday, 8:00 a.m. – 6:00 p.m.

- Sunday, 12:00 a.m. – 4:00 p.m.

How Vio Bank Compares

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Discover Bank: Discover Bank is also an online nationwide bank that offers bonuses for their checking and savings accounts! You can earn cash back rewards when you open a checking account and generous bonuses for opening a savings one.

- Capital One 360: Capital One 360, you can bank fee-free with online and mobile checking that actually pays you back. Whether you’re looking for one of their 40,000 fee-free ATMs or a Capital One location–chances are they are right nearby.

- Ally Bank: Ally Bank is another online only bank that offers various account options, but they have checking accounts. The interest rates they offer are also pretty high as well.

- CIT Bank: CIT Bank offers very similar account options as Vio Bank, but they have a wider range of CD options to choose from. They are also offering significantly higher APY for their savings, money market and CD accounts.

|

|

Bottom Line

If you aren’t too concerned about having a checking account and would rather make sure that your savings account is secured, then Vio Bank might work in your favor.

They have low minimum deposits and offer pretty high interest rates for being such a simplistic bank. But if simplicity is your style, then Vio Bank can provide it.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If you’re interested in banking with Vio Bank, see our list of the latest Vio Bank Bonuses! For more options from a variety of banks, see our list of the best bank promotions!

What is this: Vio Bank charges $5 per month for inactivity, so be sure to always check your account?

I think that’s every 12 months.

Still there should be no inactivity fee’s, a big no thank you.