Find new Zacks Trade promotions, bonuses, and offers for trading stocks, trades, bonds, options and mutual funds here.

Find new Zacks Trade promotions, bonuses, and offers for trading stocks, trades, bonds, options and mutual funds here.

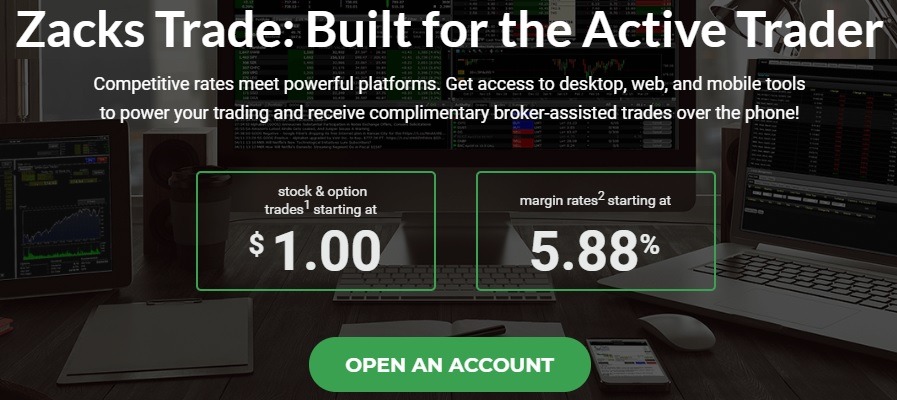

Qualify for stock and option trades starting at $1.00 with a Zacks Trade account.

About Zacks Trade Promotions

Today, Zacks Trade is the second largest independent equity research firm in North America, and Zacks Companies as a whole manage more than $5 billion in assets. Regardless of your experience level, they are committed to providing traders and investors with the cutting edge tools, research and customer support you need.

If you’re currently looking for better ways to invest your money, Zacks Trade offers you a platform where you can manage your investments and trade as low as $3 per trade. However, with this current promotion you can trade for as low as $1.

I’ll review the Zacks Trade offer below.

Editor’s Note: Along with Zacks Trade, other popular brokerage bonuses include Ally Invest, E*TRADE, Chase You Invest, and TD Ameritrade.

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| M1 Finance | Up to $2,000 Cash & free trades | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

Zacks Trade $1 Stock and Option Trades Offer

Open an account and have access to this offer from Zacks Trade

Zacks Trade is offering you trades of stocks, options, and ETFs for as low as $1 for a year.

- Account Type: Zacks Trade Account

- Availability: Nationwide

- Online Trades: As low as $1 per trade for a year

- Credit Inquiry: Unknown

- Monthly Fee: None

- Account Requirements: See below

- Closing Account Fee: None listed, Check with Zacks Trade

(No expiration date listed)

How To Earn $1 Stock & Option Trades

- Offer valid for those that fund a new Zacks Trade account

- Open with at least $2,500 USD or equivalent in existing positions or foreign currency

- Funding must occur within 60 calendar days of account opening

- You will be able to trade US Stocks, Options and ETFs for as low as $1 per trade for a year from funding date

- Current customers are eligible should the new account be of different type than their current account.

- US Stocks and ETFs priced above $1 per share will be subject to a commission of $0.01 per share with a $1 minimum for a year.

- US Stocks priced below $1 per share will be subject to a commission equal to 1% of the principal (# of shares x price per share) with a $1 minimum for a year.

- The first option in an order will be subject to a commission of $1 with each identical contract being $0.75.

- When placing a multi-leg order, the first option in each leg will incur a commission of $1 with each Identical contract being $0.75 each.

- Following a one-year period from account fund date, commissions will revert to our standard commission structure. It will start at $3.00 ($0.01 per share) for US stocks priced above $1 per share, 1% of the principal ($3.00 minimum) for US stocks priced below $1 per share, and $3.00 for the first option contract in any leg.

- The offer does not apply to foreign stock transactions, large block transactions requiring special handling, restricted stock transactions or foreign ordinary shares that trade online in the U.S. over-the-counter (OTC) market and do not settle in the U.S.

- Offer is not transferable and not valid with internal transfers.

- Zacks Trade’s margin rate starts at 5.88% compared to Charles Schwab (rate starting at 9.825%), E*Trade (rate starting at 11%), Fidelity (rate starting at 9.825%), TD Ameritrade (rate starting at 10.75%) and Vanguard (rate starting at 9.75%).

- Commissions for stocks start at $0.01 per share with a $3.00 minimum and start lower compared to Charles Schwab ($4.95 per trade), E*TRADE ($6.95 per trade), Fidelity ($4.95 per trade), TD Ameritrade ($6.95 per trade) and Vanguard ($7 for first 25 trades, subsequent $20).

- Zacks Trade commissions for options start at $3.00 for your first contract plus $0.75 any additional contract and are lower compared to Charles Schwab ($4.95 base + $0.65 per contract), E*TRADE ($6.95 base + $0.75 per contract), Fidelity ($4.95 base + $0.65 per contract), TD Ameritrade ($6.95 base + $0.75 per contract) and Vanguard ($7 base + $1.00 per contract).

- Competitor margin rates and commission data obtained from published websites as of 6/5/2019 are believed to be accurate but not guaranteed.

- Some of the brokers may reduce margin interest rates depending on account activity or margin debit balances.

- Comparisons do not include competitor discounts or promotions.

Bottom Line

This concludes all the Zacks Trade promotions and offers. Zacks Trade, give their clients the tools it takes to make the most of their trading. They offer competitive commission rates, no inactivity or maintenance fees, and access to powerful platforms. This type of account is especially catered for self-directed traders. It also offers support from licensed reps when assistance is needed.

Consequently, Zacks Trade trading costs are among the lowest in the industry. You may save hundreds per year on commission costs, margin interest, and other fees compared to competing brokers.

They also have a priority in account protection. With cutting edge encryption technology to multiple login protections, they take every precaution to ensure your assets are safe and your account is secure so you can have peace of mind.

Furthermore, bookmark this page and check back often for Zacks Trade promotions, bonuses, and offers.

Leave a Reply